Stock market trading involves many different types of risk. Some of these risks are inherent in the market itself, while others are specific to individual stocks or investment strategies. Therefore, it is very important to understand all the different types of risks before making any investment decisions.

Stock market turbulence

Stock drop

Low yield return

Think about which brand to choose

Many day traders love penny stocks because they can move 20%, 50% or more during the day!

“Why buy penny stocks”?

1、Low barriers to entry: Penny stocks usually have low share prices, which makes it possible for some small investors to buy shares. Penny stocks require less capital to buy than high-priced stocks, which can be a good entry point for novice investors who are just getting started.

2、High Liquidity: Due to the low price of penny stocks, their trading volume is relatively high, so the trading is more active and the liquidity is better. For short-term investors or investors who need to buy and sell quickly, this can provide better trading opportunities.

3、High ROI: Some penny stocks may be undervalued in the market, but these companies may have potential for growth. Therefore, buying these stocks may provide investors with a high return on investment

Rajiv Sharma

Professor

Rajiv Sharma

DOB: 11-04-1976, Mumbai India

Graduated: University of Warwick, England

Chief Analyst of BCF, utilizing companies and financial instruments to facilitate wealth creation for the organization. The income of its funds has consistently placed among the top three in the UK annual fund rankings under the direction of Rajiv Sharma and his staff, aiding the group in winning the Numerous national and international honors have been bestowed upon it, and numerous institutional funds have visited in search of prospects for collaboration. He did not forget to contribute back to society even as he became wealthy. Rajiv Sharma repeatedly urged the group members to start philanthropic donations in order to aid underprivileged populations around the world. For this reason, the International Financial Times chose him to receive the 2021 "Global Social Responsibility Award".

Rajiv Sharma is constantly worried about his native nation, particularly the growth of the financial securities market, even if he is living in the UK. Rajiv Sharma is deeply committed to the group's Asia strategy, which centers around India as the fastest-growing nation in the world. He decided to return to India in 2022 to take on the significant responsibility of strategic development. He also intends to start a private equity fund management company there with the goal of assisting Indian investors in expanding their wealth opportunities, strengthening the fundamentals of the Indian stock market, safeguarding the stock market, and defending regional interests. Following almost two years of relentless work, we have partnered with several private equity firms.

“What should you do to avoid risks to a greater extent? ? ? We will help you with the following”

We use three specific parameters to find the penny stocks that are most likely to make big gains.

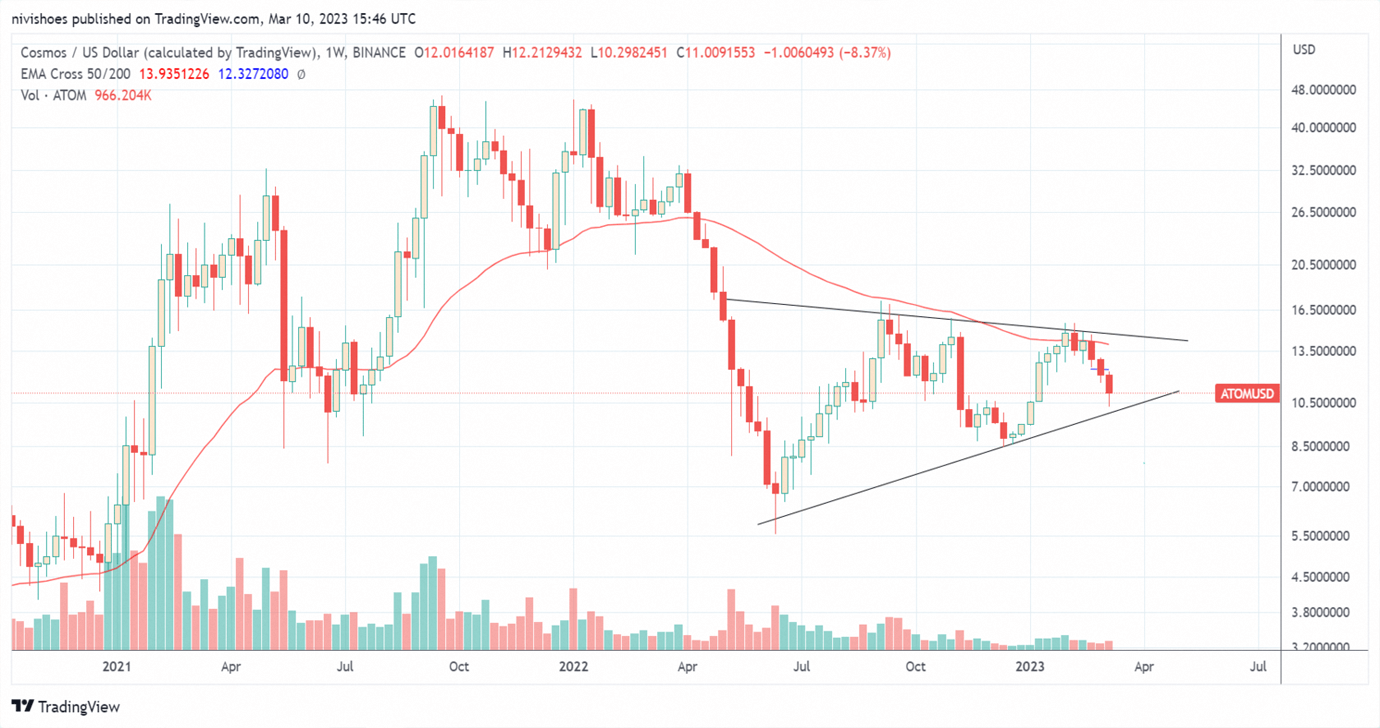

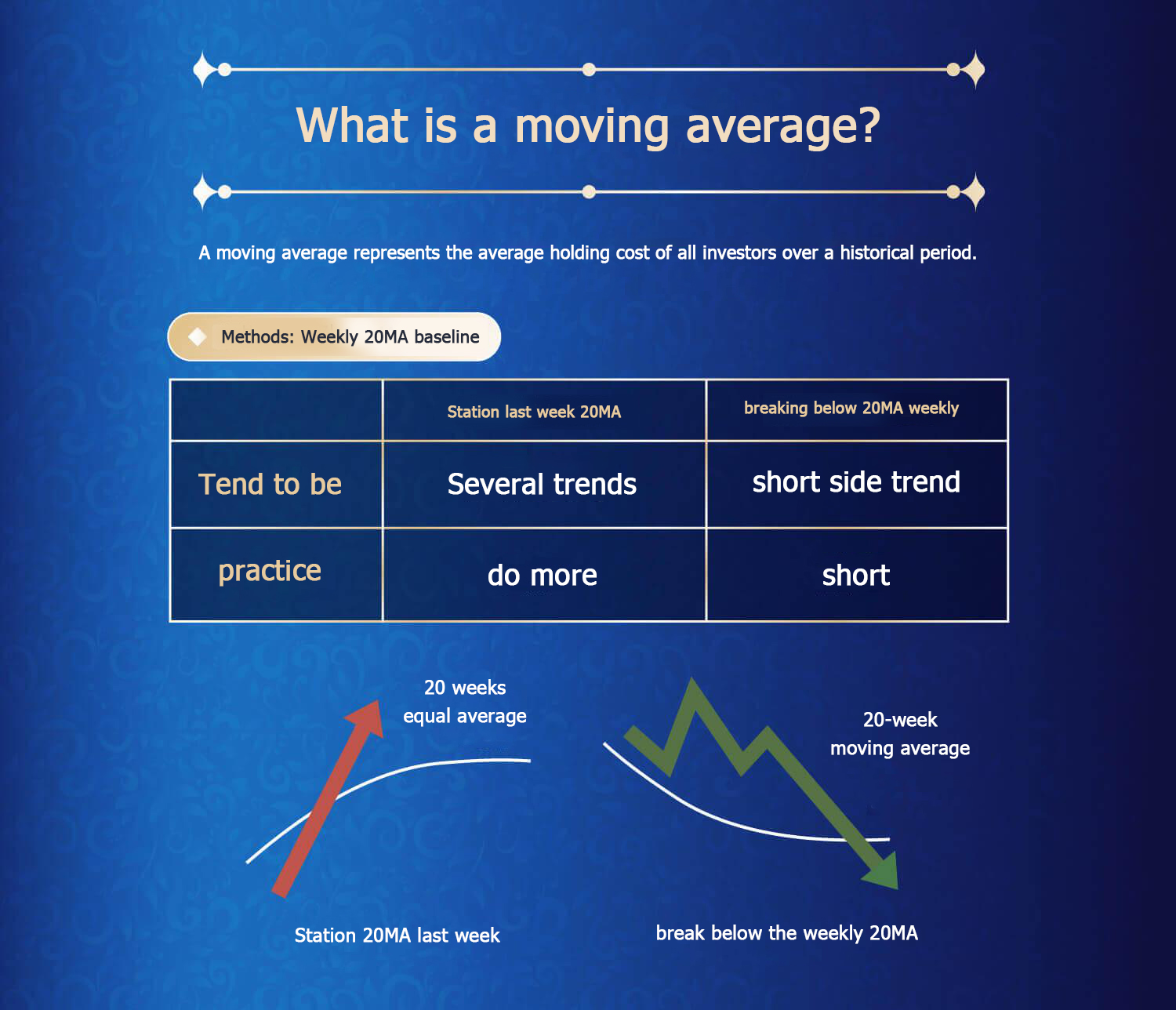

Parameter 2: Technical Indicators - It's essential to look at technical indicators such as moving averages, volume, and RSI. For instance, a stock that has a strong volume and is trading above its 20-day moving average might indicate a bullish trend. Conversely, an overbought RSI could suggest a potential sell-off in the near future.

Expert one-on-one online guidance and teaching

Share day trading strategies, momentum

trading, reversal trading

Daily pre-market trading analysis,

optimized automatic allocation,

trend reversal warning

We've given you a sample of penny stock alerts and possible trades below, based on community expert advice and a penny stock screener.

In the screenshot above, you can see that the penny stock screener with multi-strategy window shows his excellent chart technical analysis ability and stock market forecasting ability, and he will issue alerts in time to help you plan ahead in the stock market!

The 1-hour chart above shows a pullback over the next few days, never trading below the alert day low. Therefore, it is safe to buy on dips around the $2.26 area.

By the next Friday (21st April) the stock hit a high of $79.4 ($45.<> earlier in the screenshot). Be aware of the high volume on alarm day.

Now you know how to find good penny stocks. You've seen some good penny stock investing strategies. You have many more options to try.

If you want to consider choosing higher-quality stocks, you can join our community for detailed consultation and understanding. We will share our investment experience and trading strategies without reservation, Take you to know more secrets of penny stocks, help you find the penny stocks that suit you, and take you to play the penny stock market!

SMC Global Securities Limited

SMC, founded in 1990, is a diversified financial services company in India that provides brokerage services for asset classes such as stocks (cash and derivatives), commodities and currencies, investment banking, wealth management, third-party financial product distribution, research, financing, and custody services for businesses, institutions, high net worth individuals, and other retail clients, insurance brokerage (life and non life), and liquidation services Mortgage loan consulting and real estate consulting services.

About SMC Global Securities Limited SMC Global Securities Limited was founded in 1994 and is one of the trusted and award-winning financial services companies in India. The company operates in over 450 cities in India through a strong network of 2680 sub brokers and 94 branch offices. It also has an experienced and high-quality team of approximately 4000 employees, capable of meeting the financial and investment needs of approximately 2 million clients. If you want to consider choosing higher quality stocks, you can join our community for detailed consultation and understanding. We will unreservedly share our investment experience and trading strategies, take you to know more secrets of penny stocks, help you choose penny stocks that suit you, and play the stock market.